Sunday, June 13, 2010

STEPS for Commercial work (FOB)

#2. Customer accept the PO/PI and send to his Bank For Open LC.

#3. Customer Bank Issue LC for Supplier.

#4. Advising Bank receives the LC.

#5. Advising Bank Send the LC to Supplier.

#6. Supplier Accept the LC and Lien Mark to his Bank.

#7. Supplier Open BTB LC against Master LC.

#8. Supplier Shipped the Goods as per LC terms.

#9. Supplier Prepare all Export documents.

#10. Supplier Collect the BL from Forwarder.

#11. Supplier Submit Export Documents to his bank.

#12. Supplier Bank sends the Export documents to LC issuing Bank for Payment.

#13. LC issuing Bank sends Documents to Customer for Accept.

#14. Customer accept the documents and issuing Bank send payment to supplier Bank.

#15. Supplier receives his Payment on his account after deduct the BTB Amount.

How documentary credit works

#1 Contract is signed between buyer and seller, stipulating that payment is to be made by documentary credit.

#2 Buyer requests a documentary credit be issued. Buyer (applicant) asks his bank (issuing bank) to issue a documentary credit in favour of seller (beneficiary), not requiring confirmation by seller’s bank, and specifying the documents required to import the goods.

#3 Buyer’s bank verifies buyer’s creditworthiness. Issuing bank checks buyer’s creditworthiness and verifies the signatures on the documents to ensure they are valid, and then makes sure the instructions are clear and complete.

#4 Buyer’s bank issues documentary credit. Buyer’s bank issues the documentary credit and forwards it to seller’s bank through the SWIFT network. Buyer receives a copy of the message.

#5 Seller’s bank examines documents. Seller’s bank (advising bank) verifies the authenticity of the documentary credit and examines the documents to make sure they follow UCP (Uniform Customs and Practice) rules. It also checks the instructions to ensure they contain no errors.

#6 Seller is notified. Advising bank informs seller (beneficiary) that it has received a documentary credit in his favour.

#7 Seller verifies documents. Beneficiary verifies that the terms and conditions stipulated in the documentary credit match those set out in the sales contract. If beneficiary disagrees with any of the terms or conditions, he must ask the buyer to amend the terms.

#8 Goods are shipped. Seller ships the goods and prepares the documents requested in the documentary credit instructions.

#9 Seller presents documents to his bank. Seller presents the documents to his bank.

#10 Seller’s bank examines documents. Seller’s bank verifies that all documents presented comply with the documentary credit terms. Any errors may result in seller not being paid.

#11 Seller’s bank forwards documents. Seller’s bank forwards the documents to buyer’s bank with a request for payment.

#12 Buyer’s bank examines documents. Buyer’s bank in turn verifies the documents to ensure they comply with the documentary credit terms.

#13 Buyer’s bank forwards payment. If the documents comply with the terms, buyer’s bank forwards payment to seller’s bank, less applicable fees.

#14 Account is debited and documents delivered. Buyer’s bank debits buyer’s account for the amount of the documentary credit less applicable fees and delivers all documents to him. Buyer can then clear the goods through customs and take possession of them.

#15 Seller receives payment. Seller’s bank credits payment amount to seller’s account, less applicable fees.

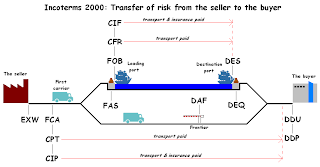

Incoterms – FOB

FOB (Free on Board) means that the seller fulfils his obligation to deliver when the goods have passed over the shop’s rail at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that point.

The FOB term requires the seller to clear the goods for export.

Also it is expressed as being Monomodal and it can only be used for transactions where sea freight is the main carriage. Therefore, as an INCOTERM, there is no application for FOB in road, rail or air transport.

For FOB to apply, the seller must be in the physical position of load the cargo over the rail under their own direct control i.e. the loading is undertaken by the seller’s own labour, or by an agent that is under the contractual control of the seller. Further his process would have to be monitored by both the seller and buyer or their representatives.

Generally, from the modern deep-sea export perspective, this control often cannot be achieved as the seller is either not allowed into the harbour area or, even in those extreme circumstances where they are, they have no influence over the party loading the vessel.

The INCOTERM FOB still has an application in some markets, but these are more and more in the minority. Note that the use of an ‘on-board’ Bill of Lading or mate’s receipt could be appropriate in recording the passage risks under FOB making FOB one of the few terms still unavoidably dependant on such documents.

Incoterms – FCA

FAC (Free Carrier) means that the seller fulfils his obligation to deliver when he has handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the named place or point. If no precise point is indicated by the buyer, the seller may choose within the place or range stipulated where the carrier shall take the goods into his charge. When, according to commercial practice, the seller’s assistance is required in making the contract with the carrier (such as in rail or air transport) the seller may act the buyer’s risk and expense.

FAC requires the seller to take responsibility for risks and costs up to this handover, including export customs clearance.

It is important to consider that the nature of the carrier being used, and the various points of transfer that different modes of transport may involve, are subject to extreme variables. It is common that the transport used to deliver or handover is a different than the actual transport to be used for the main carriage (e.g. collected by road for an airfreight export). The term may well involve detailed instruction to make such distinctions and it should be noted that multimodal transport documents better serve this term than traditional documents such as Bills of Lading or Airway bills.

For deep-sea transactions, FCA represents an excellent alternative to FOB, which is inappropriate in most modern port operations. However, under FCA the seller hands over risks/control of the cargo at a point prior to the vessel, frequently prior to the port. Although this reflects the physical condition of much sea freight trade conducted using ‘FOB’; it is a departure from the commoner financial interpretation of ‘FOB’. This normally obligates the seller to pay for the origin handling/loading and/or stowage charges raised by the port.

Under FCA these charges are for the buyer’s account. If this is not acceptable, the term may be modified to represent the passage of FCA risks with ‘FOB’ costs.

FCA may involve the carrier collecting from the seller or the seller delivering to the carrier, dependant on the conditions of the sales contract.

Incoterms – FAS

FAS (Free Alongside Ship) is Monomodal in that it may only be used for transaction where the main carriage is by sea freight. Note that the entire journey need be by sea, but the moment of ‘export’ must be.

Under this term, which has a considerably long tradition, risk and responsibility pass from the seller to the buyer when the goods are placed alongside a named ship (or a ship operated by a named service) at a named area within a named port. This means that buyer has to been all costs and risks of loss on damage to the goods from that moment.

The essential aspect of the term is that the vessel is in port prior to the seller delivering the cargo into the port area.

However, in many markets, the seller is not allowed into the harbour area. Even if the seller can enter the port area, most operations involve the placing of cargo into a berth where the vessel in question is intended to arrive, as opposed to it having physically docked prior to the arrival of the cargo. Thus the vessel comes to the cargo rather then the cargo coming to the vessel.

There are significant risks associated with the older sea freight terms (such as FAS, FOB, CFR/CIF etc.) specifically with regard to the transport documents issued. Careful consideration should be given to the appropriate section of the official INCOTERMS 2000 text dealing with ‘proof of delivery’. In many cases, the modern document issued by lines may present risk-management complications to the seller when using such an old term as FAS.

The use of this term in the charter and bulk markets is attractive as an alternative to may of the traditional chartering terms that are often subject to unique definitions from country to country – or even between ports within one country.

Incoterms – EXW

EXW (Ex works) means that the seller fulfils his obligation to deliver when he has made the goods available at his premises (i.e. works, factory, warehouse, etc.) to the buyer. In particular, he is not responsible for loading the goods on the vehicle provided by the buyer or for clearing the goods for export, unless otherwise agreed. The buyer bears all costs and risks involved in taking the goods from the seller’s premises to the desired destination. This term thus represents the minimum obligation for the seller and the maximum involvement of the buyer in the movement of the goods from the point of ‘works’.

The statement ‘EXW’ must be qualified to give the address of the ‘works’, which may be a factory, site or warehouse etc. Care should be taken to taken to note that the actual point of manufacture might well very from the place where the seller operates their commercial undertaking.

Under INCOTERMS 2000, risk and responsibility pass from the seller to the buyer when the cargo is made available on the ground at the ‘works’, at or on the agreed future date or future time, uncleared through customs.

The seller must give advance notice of availability (how much notice would have to be predetermined e.g. through the sales contract). This point is important as the buyer assumes liability for all risks from the time of availability on the ground and is therefore exposed from that moment up to the event of collection. During this period, the buyer is liable for all risks to the cargo, even though they are not yet under the buyer’s physical control, and this is further aggravated by the fact that the goods are generally uninsured throughout this period too.

The buyer and seller should only consider EXW when the buyer can actually arrange the customs clearing prior to export and for the immediate collection of the cargo on availability. The Seller should note that the export of the goods is NOT guaranteed under EXW and the buyer may, for example, opt to keep the goods in the country of origin.

Although EXW is a popular term it remains complex. EXW is rarely compatible with documentary credits (for example) – and the term FCA offers a more manageable alternative.

Incoterms - DES/DEQ

DES (Delivered Ex Ship) is a Monomial term. Although not triggered by the use of the ship's rail, the point of handover (ship's side, arrived) will be inappropriate in a modern port. The buyer cannot control at a point in a restricted port area. An alternative D term such as DDU might be better suited to represent an achievable point of handover for both parties.

DES will often financially correlate to CFR. However, DES represents CFR without the disadvantages of placing risks on the buyer who have no control. (See CFR)

From the seller's perspective, DES reverses the risk advantages of CFR, placing all risks with the seller until the cargo arrives at the named port.

DEQ (Delivered Ex Quay) extends the shipper's responsibility beyond the arrival of the vessel to the point where the goods are discharged.

Although not triggered by the use of the ship's rail, the point of handover (landside on the harbour, duty paid) is frequently inappropriate in a modern port environment. The buyer may not be able to control at that point and an alternative D term such as DDP may be better suited to represent an achievable point of handover for both parties.

Sellers are cautioned that they must be in a position to pay the destination discharge fees both in physical terms as well as administratively in accordance with any Exchange Control Regulations applicable in the country of Origin.

Caution is appropriate when using D prefixed terms with Documentary Credits as few 'documents' are geared to record the passing of risks on arrival.

Incoterms - DDU

Incoterms - DDP

DDP (Delivered Duty Paid) is a Multimodal term that must be qualified by specifying the place to which the seller is taking responsibility for transport costs and the risks of transit. These risks and costs include the payment of domestic duties in the buyer's country and any ancillary charges associated with the import clearing process at destination.

As with all of the D prefixed terms, this term is not easy to use in conjunction with a Documentary Credit and in the case of DDP this payment difficulty extends to any form of Exchange document. As a multimodal term, DDP requires the use of Multimodal transport documents over monomial documents such as Bills of Lading or Airway bills.

Sellers are cautioned that the payment of foreign duties and taxes may be contrary to the Exchange Control regulations of their country and that they should clarify on this point from their bank or appropriate authority.

Equally, both parties should consider VAT if payable in the buyer's country. DDP may be modified to exclude the seller from having to pay a VAT that the buyer could recover directly. Otherwise, the seller's price may include this amount which the buyer could recover actually.

Regulations regarding sellers claiming VAT paid to foreign revenue services vary from country to country, and there is no clear-cut position in this matter. Both parties should seek guidance in this.

Additionally, although the seller will pay Duties, the buyer would be named on the import customs entry and will have the obligation to the domestic Customs Authority for the accuracy of the declared tariff headings used and the rates of duty applied. Subsequently these should prove to be incorrect the buyer will have the obligation to bring any under recovery to account.

Incoterms - DAF

DAF (Delivered At Frontier) is a monomial (land) expression which should be further qualified by naming the frontier (border post) up to which the seller is prepared to take responsibility for transport costs and the corresponding risks of transit.

The frontier is deemed to be on the seller's side of the applicable border unless the term is modified to express that the point of transfer is the frontier on the buyer's side of the border.

The seller must clear the cargo through customs before handover on the export side of the border, whereas the buyer must clear the cargo through customs on the import side.

DAF can vary from other D terms in that the seller may not be responsible for all or even partial of the main carriage because the Frontier falls on the seller's side of the border. For example, the seller may pass risk and responsibility at the first of these, obligating the buyer to arrange the main carriage thereafter if the transit involved the movement of cargo through several frontiers

As a land term the application of DAF is for land-based operations and other D terms such as DDU or DDP should be considered if the transaction is not land-based. (I.e. it is not exclusively road or rail or a road/rail combination).

Incoterms - CPT/CIP

Incoterms - CPT/CIP

CPT (Carriage Paid To) is the multimodal equivalent of CFR. The named place where the costs end by seller can be a point other than a seaport (as well as being a seaport) in the buyer's country.CPT may be used for airfreight, road freight and rail freight as well as for sea freight when the ship's rail serves no purpose. E.g. if the destination is an inland point or a modern port with conditions as discussed under FOB.

CPT requires the use of multimodal documents and documents such as Bills of Lading or Airway bills may prove inappropriate in recording the passage of risks under this term.

Under CPT, seller passes the risk and responsibility to the buyer when the cargo is handed to the first carrier (with a carrier defined as either an Actual or Contractual carrier i.e. a Freight Forwarder or Multi Transport Operator could act as 'carrier' as could an airline or shipping line).

However, responsibility for costs only transfer when the goods arrive at the stated place where carriage is 'paid to'.

Buyers expressed the cautions on using CFR are equally applicable to CPT with additional complications in the transfer of risks can begin earlier. If the carrier is collecting the cargo from the seller's premises then the risks of carriage pass to the buyer at that point, whereas the buyer's ability to control the costs and schedule of carriage only pass at the destination point.

Although these reservations warrant serious consideration for a buyer, they represent great risk-management opportunities for the seller.

CIP (Carriage & Insurance Paid to) represents CPT with the addition of Insurance. The cautions and notes made regarding CPT equally applicable to CIP.

Incoterms CFR/CIF

CFR (CNF/C&F) (Cost and Freight) has a long history in the INCOTERMS.

As an INCOTERM, seller passes the risk to the buyer when the cargo crosses the ship's rail at the port of origin. However, the seller passes the responsibilities for the costs of transit to the buyer at the port of destination only. Both of CFR and CIF are Monomial expressions used when the main carriage is by sea as well as suited to the use of Bills of Lading.

Because the ship's rail is seen as triggering these terms, it is often inappropriate to use either in a modern port and reference should be made to the notes on this subject under FOB.

Buyers are disadvantaged which must take risks for a period of carriage during that the buyer has no means of controlling or limiting those risks. Seller controls all the carrier used, the costs incurred for carriage and the schedule of the carriage. The buyer must consider this disparity before accepting these contracts. From the seller's perspective, these terms represent exceptional risk-management opportunities and are actively pursued as a consequence.

CIF (Cost, Insurance and Freight) represents the condition of CFR with the addition of Insurance. This is the first of only two terms that place a compulsory responsibility for insurance on the seller. Under all other terms, the buyer considers insurance as an optional responsibility. (Refer CIP)